As we reach the midpoint of 2025, the U.S. housing market finds itself at a crossroads. The pandemic housing boom is long behind us, replaced by a market that is cautiously seeking balance. Higher mortgage rates, cautious buyers, and rising housing inventory are reshaping how both buyers and sellers should approach their next move.

According to Nadia Evangelou, senior economist and director of real estate research at the National Association of Realtors (NAR), “The housing market is at a turning point.”¹ This turning point offers both opportunities and challenges—making it critical to understand the latest real estate market trends if you’re planning to buy or sell a home in 2025.

Below, we break down four major forces influencing the housing market this year and what they mean for you.

1. Home Sales Remain Below Normal, But Momentum Is Returning

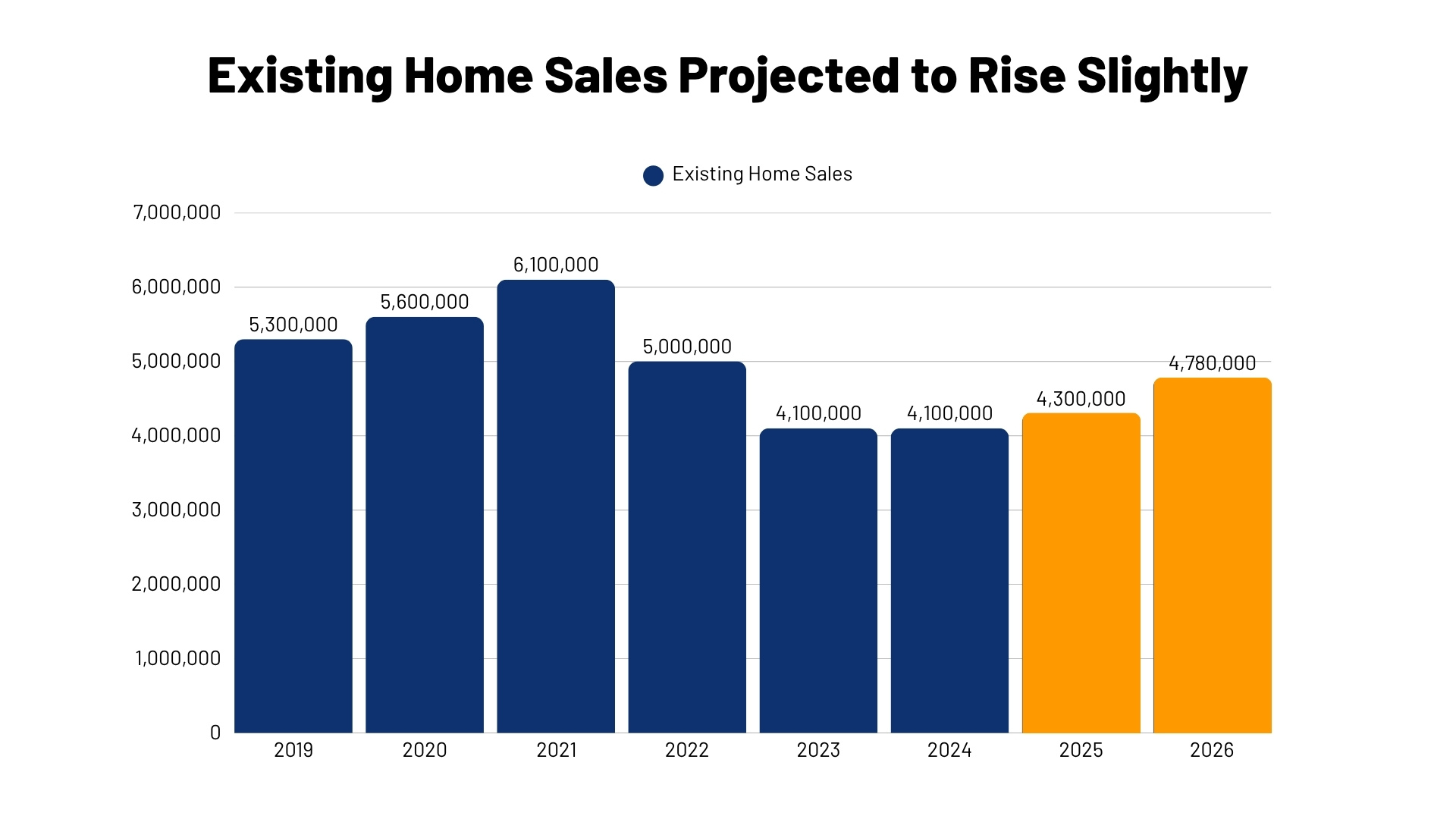

While National Association of Realtors housing statistics show a modest uptick compared to last year, overall activity remains well below pre-pandemic norms.²,³ High borrowing costs and affordability challenges are keeping many buyers on the sidelines.⁴

Lawrence Yun, NAR’s Chief Economist, explained that “Home sales have been at 75% of normal or pre-pandemic activity for the past three years, even with seven million jobs added to the economy. Pent-up housing demand continues to grow, though not realized. Any meaningful decline in mortgage rates will help release this demand.”³

Still, positive signs are emerging. A larger number of homes on the market, coupled with selective price reductions, is drawing new interest. Realtor.com senior economic analyst Hannah Jones noted to Newsweek in May, “This summer’s housing market is expected to display familiar seasonal patterns, such as increased home sales and rising prices, but overall activity may remain subdued as buyers contend with elevated housing costs.”⁵

What this means for you:

- Buyers: May benefit from less competition and stronger negotiating power.

- Sellers: Must align pricing strategies with today’s buyer expectations to stand out in a cautious market.

2. Mortgage Rates Stay Elevated but Show Stability

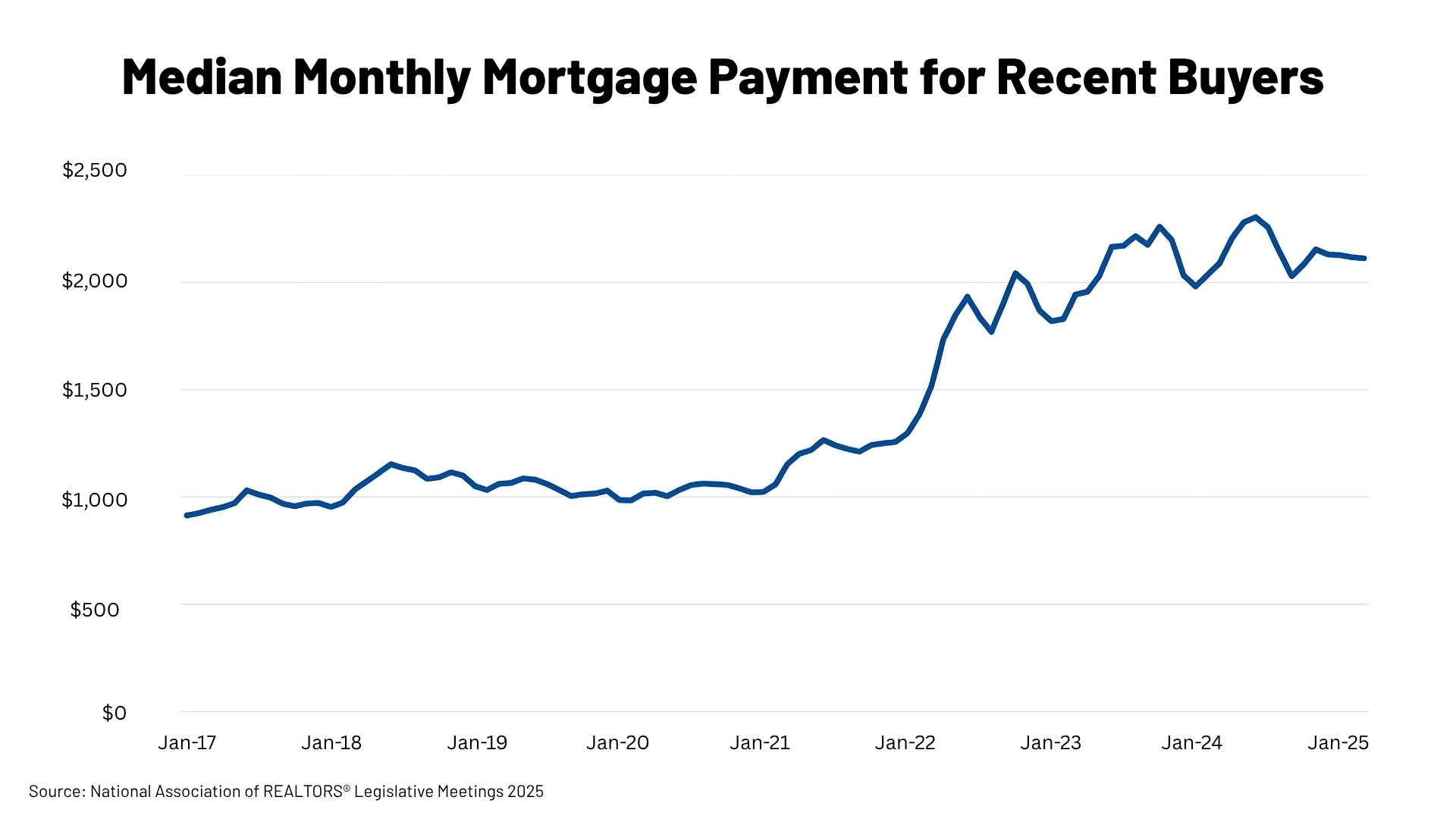

Thirty-year fixed mortgage rates are currently hovering below 7%. Yun forecasts they will average 6.4% in the second half of 2025.⁶ While this is far higher than the sub-3% rates of the pandemic, it appears to be the “new normal.” “Persistently high mortgage rates mean affordability remains top of mind,” explains Jones.⁵

For many buyers, the affordability crunch is real: monthly payments have more than doubled compared to pre-pandemic years, driven by both higher prices and borrowing costs.⁷ To adapt, builders and sellers are offering concessions such as rate buydowns and closing cost assistance.⁸

What this means for you:

- Buyers: Waiting for significantly lower rates may not be realistic. Explore seller concessions now and consider refinancing later if rates ease.

- Sellers: Incentives like buydowns and cost assistance can widen your buyer pool and make your property more attractive.

3. Rising Inventory Is Shifting Market Power Toward Buyers

One of the most notable shifts in 2025 is the surge in active listings. Data shows there are 33.7% more sellers than buyers on the market this year.⁹

Several factors contribute: the return-to-office movement has softened demand in some regions, affordability challenges persist, and many homeowners are finally listing after years of waiting. As a result, many metros in the South and West Coast are now buyer’s markets. Homes are sitting longer, and stale inventory is accumulating. “The balance of power in the U.S. housing market has shifted toward buyers,” notes Redfin senior economist Asad Khan.⁹

What this means for you:

- Buyers: Enjoy greater leverage, more options, and better negotiating power.

- Sellers: Must act strategically—pricing competitively, staging well, and being flexible on terms.

4. Home Prices Show Early Signs of Softening

After years of record appreciation, home prices are leveling off. Some Northeast and Midwest markets continue to see increases, but many regions—including parts of the Sun Belt—are reporting declines. In fact, Newsweek reported that home values dropped in more than half of U.S. states during the first half of 2025.⁵

According to Redfin housing price predictions, the median U.S. home price is expected to remain flat in Q3 and dip about 1% year-over-year by the end of 2025.⁸ Sellers are adjusting expectations, as the sky-high comps of 2021–2022 no longer apply. Affordability remains a key factor: households earning $75,000 annually can afford only 20% of homes on the market today, compared with nearly 50% pre-pandemic.¹

Still, an ongoing supply shortage is preventing dramatic declines. Finance expert Michael Ryan told Newsweek, “The housing market isn’t crashing dramatically, more like it’s finally coming back down to earth from a sugar high.”⁵

What this means for you:

- Buyers: May benefit from softening prices in some regions. Tools like the Zillow home value forecast can help track shifts in your target market.

- Sellers: Should embrace realistic pricing strategies to generate interest and avoid extended time on market.

Making Smart Real Estate Moves in 2025

While national reports give an overview, real estate is always local. Market conditions can vary greatly depending on your neighborhood.

- Buyers: You’ll find more choice and negotiating room but must remain cautious about financing.

- Sellers: Success depends on aligning expectations with today’s conditions—not yesterday’s highs.

- Homeowners: Now is an ideal time to consider whether refinancing, staying put, or leveraging equity makes the most sense.

A knowledgeable real estate professional can provide the local insights and strategies you need to navigate today’s complex housing market. Reach out today to discuss your goals and create a plan tailored to the mid-2025 housing landscape.

Sources

- National Association of Realtors – America’s Housing Affordability Gap Persists

- Zillow – Home Value & Sales Forecast

- National Association of Realtors – Existing Home Sales Data

- MarketWatch – Home Buyers Finding Silver Linings

- Newsweek – Housing Market Shifts

- NAR – Residential Economic Issues & Trends Forum

- NAR – Legislative Meetings 2025 (Presentation Slides)

- Redfin – Home Price Forecast 2025

- ResiClub – More Sellers Than Buyers

- Realtor.com – Danielle Hale Presentation Slides 2025